In today's competitive market, businesses are leveraging flexible payment options like installment plans and buy-now-pay-later (BNPL) schemes to boost sales and customer experience. Research shows these options significantly impact purchasing decisions, especially in sectors like automotive services, making previously unaffordable products more accessible. By providing simple and convenient payment processes, businesses can encourage impulse buys, foster brand loyalty, and appeal to a broader customer base during economic uncertainties, ultimately driving more sales.

In today’s competitive market, businesses seeking to boost conversion rates can’t afford to overlook the power of flexible payment options. This article delves into how consumer behavior is influenced by various payment methods and explores psychological factors driving the preference for flexibility over traditional choices. We’ll guide you through implementing effective solutions, sharing case studies of successful businesses that have harnessed this trend. Learn strategies for customization and optimization to create seamless, user-friendly experiences that drive repeat purchases and elevate your conversion rates.

- The Impact of Flexible Payment Options on Consumer Behavior

- – Exploring how different payment methods influence purchasing decisions

- – Discussing the psychological factors behind choosing flexible vs. traditional payment options

The Impact of Flexible Payment Options on Consumer Behavior

In today’s competitive market, businesses are constantly seeking ways to enhance their customer experience and boost sales. One powerful tool that has gained significant traction is offering flexible payment options. This simple yet effective strategy can significantly impact consumer behavior and decision-making processes. When customers are presented with a range of flexible payment plans, they feel more empowered and are more likely to make purchases without hesitation.

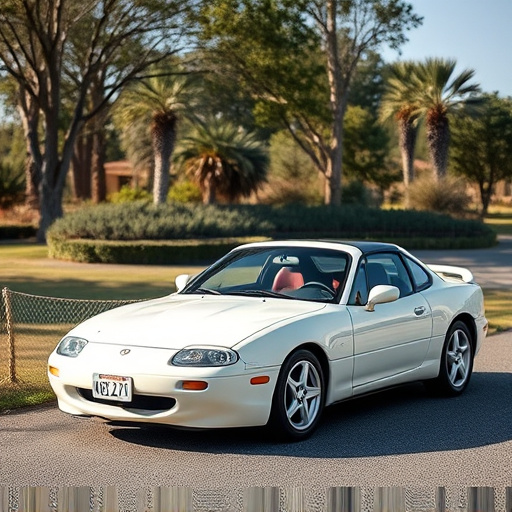

The ability to choose between various payment methods, such as installment plans or buy-now-pay-later options, provides consumers with added convenience and control. This flexibility is particularly appealing to those who prefer not to spend large sums of money at once or who have specific financial constraints. For instance, in the automotive industry, flexible payment options for services like ceramic window tinting or paint protection film can attract a broader customer base. UV protection products, as part of these flexible plans, might become more accessible to folks who previously found them out of reach due to their cost, thereby increasing sales and conversion rates significantly.

– Exploring how different payment methods influence purchasing decisions

In today’s competitive market, understanding how different payment methods shape purchasing decisions is crucial for businesses aiming to boost conversion rates. Flexible payment options like installment plans or buy-now-pay-later (BNPL) services have emerged as powerful tools to attract and retain customers. Research shows that offering these alternatives can significantly influence consumer behavior, especially in sectors like automotive customization. For instance, when it comes to purchasing a high-value item like a car with ceramic coating or other premium automotive services, consumers often consider the financial impact of their choices. Flexible payment plans make these expensive endeavors more accessible, appealing to a broader customer base and increasing sales opportunities.

The psychological aspect of payment methods cannot be overlooked. Simple and convenient payment processes create a positive user experience, encouraging impulse buys and fostering brand loyalty. Conversely, rigid or complicated checkout procedures may deter potential customers, especially those seeking car customization options. By providing various flexible payment options tailored to different consumer preferences, businesses can streamline the purchasing journey, enhance customer satisfaction, and ultimately drive more sales in a competitive market.

– Discussing the psychological factors behind choosing flexible vs. traditional payment options

When consumers are presented with payment options, their choices aren’t solely based on price or convenience. Psychological factors play a significant role in deciding between traditional and flexible payment methods. The fear of commitment often drives people towards traditional payment options, as they provide an immediate sense of control and security. On the other hand, flexible payment options appeal to those who value freedom and adaptability. This preference is especially noticeable in the premium automotive services market, where customers opting for services like vinyl wraps or ceramic window tinting might be more inclined to choose flexible plans to fit their sporadic budgets.

The perception of flexibility itself acts as a powerful motivator. It creates an illusion of having more control over one’s spending, which is especially enticing in uncertain economic times. This psychological shift towards flexible payment options has been further accelerated by the digital transformation of purchasing behaviors, making it easier for businesses to offer and promote these alternatives effectively.

Flexible payment options have emerged as powerful tools for enhancing consumer experiences and driving conversion rates. By offering choices that cater to modern purchasing behaviors, businesses can tap into a broader market, foster customer loyalty, and ultimately boost sales. The psychological appeal of flexibility cannot be overlooked, as it provides relief from financial strain and encourages impulsive yet thoughtful purchases. Embracing these innovative payment solutions is a strategic move for any company aiming to stay competitive in today’s dynamic market.