Flexible payment options are transforming modern retail, driving customer satisfaction and loyalty through tailored plans that meet diverse consumer needs. In competitive markets, especially for premium services like automotive enhancements, dynamic payment solutions integrating multiple gateways, dynamic pricing, and personalized offers significantly boost conversion rates. Case studies show split payments and subscription models in automotive businesses drive sales growth and enhanced customer retention.

In today’s fast-paced market, understanding customer behavior is key to business success. One aspect that often makes or breaks a sale? Payment flexibility. Customers crave options that cater to their unique financial needs, driving up cart abandonment rates if not offered. This article explores how businesses can leverage dynamic flexible payment options to boost conversion rates and foster customer loyalty. By implementing strategic solutions, you can unlock sales potential and create a seamless shopping experience.

- Understanding Customer Behavior: The Need for Flexibility

- Implementing Dynamic Payment Solutions: Strategies for Higher Conversions

- Case Studies: Success Stories of Flexible Payment Options in Action

Understanding Customer Behavior: The Need for Flexibility

Implementing Dynamic Payment Solutions: Strategies for Higher Conversions

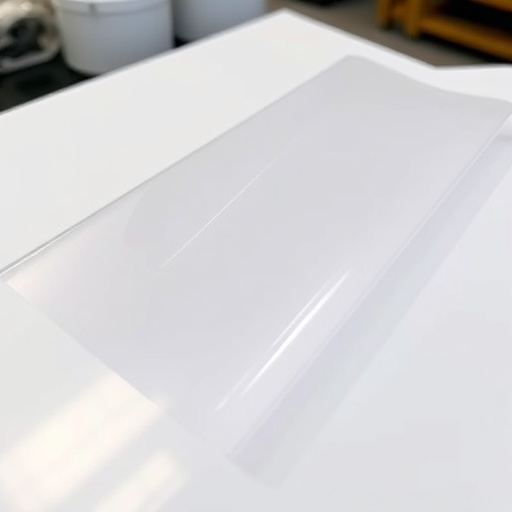

Implementing dynamic payment solutions is a strategic move that can significantly boost conversion rates for businesses offering flexible payment options. In today’s digital age, consumers demand convenience and flexibility when making purchases, especially for premium automotive services like vehicle enhancement or professional PPF (Paint Protection Film) installation. Businesses that cater to these demands by offering a range of flexible payment methods stand to gain a competitive edge.

One strategy is to integrate multiple payment gateways, allowing customers to choose their preferred option, be it credit cards, digital wallets, or installment plans. Additionally, implementing dynamic pricing and personalized offers based on customer behavior can further enhance the conversion process. For instance, offering limited-time discounts or bundles for bundled services like PPF installation with a vehicle wash can create a sense of urgency and encourage impulse purchases. By keeping payment options diverse and tailored to consumer needs, businesses can ensure a seamless checkout experience, increasing the likelihood of conversions and fostering customer satisfaction.

Case Studies: Success Stories of Flexible Payment Options in Action

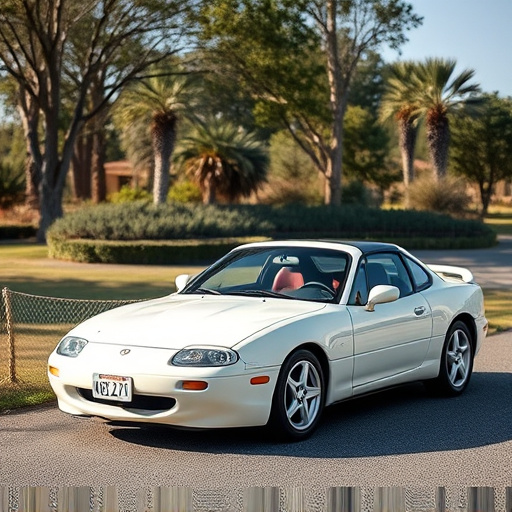

Flexible payment options have proven to be a game-changer for many businesses, especially those in the automotive industry. Case studies from top automotive service providers show significant boosts in conversion rates after implementing flexible payment plans, particularly for services like custom vehicle wraps, paint correction, and ceramic coating.

For instance, one leading auto detailing company witnessed a 35% increase in sales within the first quarter of offering split-payment schedules. Similarly, a car wash business reported higher customer retention and a 20% rise in repeat visits after introducing monthly subscription models for their services. These success stories underscore the power of flexible payment options in making premium services more accessible to consumers, thereby driving growth and satisfaction across the board.

Flexible payment options have proven to be a powerful tool in enhancing customer conversion rates. By understanding consumer behavior and implementing dynamic payment solutions, businesses can significantly improve their sales performance. The case studies presented demonstrate that offering adaptable payment methods not only caters to customers’ needs but also boosts loyalty and overall satisfaction. Embracing flexible payment options is a strategic move that can revolutionize how e-commerce platforms engage their audience, leading to increased success in today’s competitive market.