In northeast Florida, Personal Injury Protection (PIP) insurance with its 14-day rule is essential for building resilient communities. This coverage guarantees access to medical care and financial support up to $10,000, regardless of fault. The 14-day rule mandates insurer approval of medical treatments within this timeframe, aiding swift claim processing. By understanding this rule, residents can navigate healthcare decisions effectively and ensure prompt benefits. PIP also addresses healthcare disparities between rural and urban areas, offering tailored plans with affordable coverage. Community organizations play a crucial role in educating residents about the 14-day rule, advocating for equal access to healthcare services, and empowering individuals to make informed insurance decisions.

In northeast Florida, understanding PIP (Personal Injury Protection) insurance is crucial for fostering robust community health. This article delves into key aspects shaping local residents’ lives, from deciphering the complex 14-day rule to exploring PIP’s role in enhancing healthcare access across diverse regions. We navigate challenges ensuring fair coverage, emphasize community engagement through education, and look ahead to the future of PIP insurance, considering regional adaptability and growth. By understanding these dynamics, we empower ourselves to serve our communities better.

- Understanding PIP Insurance: A Key Component for Northeast Florida Communities

- The 14-Day Rule: Unraveling Its Impact on Local Residents

- Enhancing Access to Healthcare: PIP's Role in Serving Diverse Regions

- Navigating Challenges: Ensuring Fair Coverage for All

- Community Engagement: Educating Folks About Their Insurance Rights

- The Future of PIP Insurance: Exploring Regional Adaptability and Growth

Understanding PIP Insurance: A Key Component for Northeast Florida Communities

In northeast Florida, understanding PIP (Personal Injury Protection) insurance is crucial for fostering robust and resilient communities. PIP insurance plays a key role in ensuring that individuals involved in car accidents receive necessary medical care and financial support, regardless of who’s at fault. This type of coverage helps cover expenses like medical bills, lost wages, and other related costs up to $10,000. Moreover, the 14-day rule associated with PIP insurance allows policyholders to initiate claims promptly, ensuring they receive the benefits they’re entitled to without unnecessary delays.

By recognizing the importance of PIP insurance, northeast Florida communities can better navigate accident scenarios and support their members during difficult times. It empowers individuals to access quality healthcare and financial stability, contributing to a healthier and more resilient social fabric. This understanding is essential for promoting safety, peace of mind, and overall well-being within our region’s diverse communities.

The 14-Day Rule: Unraveling Its Impact on Local Residents

In northeast Florida, the 14-Day Rule, a provision within PIP (Personal Injury Protection) insurance, significantly influences local residents’ experiences with healthcare and financial burden. This rule mandates that individuals injured in auto accidents have their medical treatment approved by an insurance company within 14 days of seeking care, or risk having their claims denied. The impact is twofold: it facilitates swift healthcare authorization, ensuring timely access to necessary treatments, and it establishes a structured process for managing medical expenses following accidents.

However, the 14-day timeline can present challenges for residents, especially those with complex or prolonged recovery paths. Strict adherence to this rule may lead to delays in receiving crucial care, potentially impacting overall health outcomes. Understanding and navigating this rule is essential, as it empowers residents to make informed decisions regarding their healthcare while also holding insurance companies accountable for prompt claim approvals.

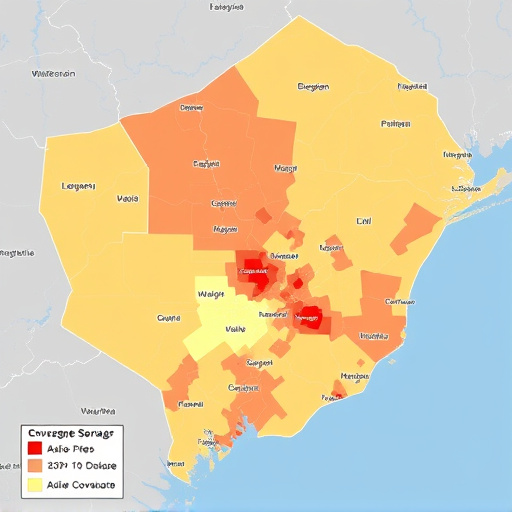

Enhancing Access to Healthcare: PIP's Role in Serving Diverse Regions

In northeast Florida, access to healthcare is a diverse challenge, with rural areas facing unique obstacles compared to urban centers. This is where Programs for Insurance Protection (PIP) plays a pivotal role. PIP insurance is designed to ensure that all residents have affordable health coverage, regardless of their location or background. One key aspect is the 14-day rule, allowing individuals to enroll in a PIP plan within 14 days of moving to the region. This provision facilitates seamless transition and access to essential healthcare services for new community members.

By offering tailored plans, PIP caters to diverse regions’ needs. In rural areas with limited medical facilities, PIP ensures that residents can access specialized care without the burden of excessive out-of-pocket expenses. This enhanced accessibility contributes to the overall well-being of northeast Florida communities, fostering a healthier and more inclusive environment where everyone has the opportunity to thrive.

Navigating Challenges: Ensuring Fair Coverage for All

Navigating Challenges in serving communities across Northeast Florida requires a keen focus on ensuring fair coverage for all residents, regardless of their circumstances. One significant hurdle is understanding and addressing disparities in PIP (Personal Injury Protection) insurance coverage. The 14-day rule, which dictates the time frame to accept or decline additional medical benefits, can be complex, especially for those unfamiliar with their policy details.

Community organizations play a vital role in educating residents about these nuances, advocating for clearer communication from insurers, and promoting equal access to healthcare services. By raising awareness about the PIP insurance 14-day rule, these groups empower individuals to make informed decisions regarding their health and financial well-being, fostering a more inclusive and supportive environment throughout Northeast Florida.

Community Engagement: Educating Folks About Their Insurance Rights

Community engagement plays a vital role in ensuring folks throughout northeast Florida understand their insurance rights, particularly regarding Personal Injury Protection (PIP) insurance. Many residents may not be aware of the 14-day rule, which allows them to review and make changes to their PIP coverage within a short timeframe after purchasing or renewing their policy. Educating the community about this rule empowers individuals to take control of their financial security in the event of an accident.

Through workshops, informational sessions, and digital resources, local organizations can break down complex insurance jargon and provide clear guidance on navigating PIP policies. By fostering open dialogue and encouraging questions, these efforts help dispel myths and misconceptions, allowing community members to make informed decisions that align with their unique needs and circumstances.

The Future of PIP Insurance: Exploring Regional Adaptability and Growth