Soft tissue shockwave therapy (STS) coverage varies among insurance policies due to its relative novelty. Patients should review their policy and consult insurers before scheduling sessions to confirm eligibility, ensuring access to non-invasive treatments for joint pain and sports injuries.

Soft tissue shockwave therapy (SWS) has emerged as a non-invasive treatment option for various musculoskeletal conditions. However, patients often wonder if their insurance covers these sessions. This article delves into the coverage of SWS, exploring insurance policies’ stances and providing insights on navigating claims processes to maximize your options. Understanding these aspects is crucial when considering SWS as a potential treatment modality.

- Understanding Soft Tissue Shockwave Therapy Coverage

- Insurance Policies and Their Stances on Shockwave Therapy

- Maximizing Your Options: Navigating Claims Process

Understanding Soft Tissue Shockwave Therapy Coverage

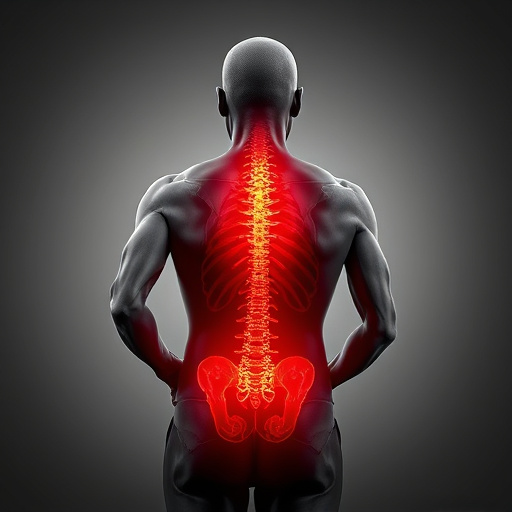

Soft Tissue Shockwave Therapy (SWT) is a non-invasive treatment gaining popularity for various conditions, including herniated disc treatment and lower back pain. Understanding insurance coverage for these sessions is crucial for patients considering this advanced therapy option. The coverage can vary significantly depending on your policy and the specific reason for the treatment.

Many health insurance plans in today’s market are starting to include SWT as a covered benefit, recognizing its effectiveness in providing neck pain relief and treating musculoskeletal disorders. However, policies differ in their limits and requirements. For instance, some plans might cover a certain number of sessions per year, while others may demand prior authorization for reimbursement. Patients should review their policy documents or contact their insurance providers to determine if their particular plan includes coverage for SWT, especially when considering it as an alternative or adjunctive treatment for conditions like herniated discs and chronic neck pain.

Insurance Policies and Their Stances on Shockwave Therapy

Many insurance policies take a nuanced approach when it comes to covering alternative treatment methods like soft tissue shockwave therapy (STS). While some plans may explicitly include STS as a covered service, others might classify it as experimental or investigative, requiring out-of-pocket expenses. This inconsistency is primarily due to the relatively recent emergence of STS as a treatment option and ongoing research into its long-term effectiveness.

In general, policies that focus on traditional medical procedures are more likely to cover STS for conditions like chronic headache relief, sciatica relief, or personal injury chiropractic care. However, policies designed for specialized treatments or those with strict guidelines on alternative medicine might not provide coverage. It’s essential for individuals considering STS therapy to review their specific insurance policy and consult with their insurer to understand the scope of coverage before scheduling sessions.

Maximizing Your Options: Navigating Claims Process

Navigating the claims process for soft tissue shockwave therapy sessions can seem daunting, but understanding your options and maximizing coverage is key to achieving joint pain relief and optimal sports injury recovery. The first step involves thoroughly reviewing your insurance policy to identify specific benefits related to non-invasive treatments like functional rehabilitation techniques. Many policies do cover such therapies, especially when prescribed by a healthcare professional for legitimate medical conditions.

Don’t hesitate to reach out to your insurer directly if you have questions about coverage. They can provide valuable insights and help clarify any eligibility requirements or exclusions. By proactively engaging in this process, you’ll be better equipped to ensure that your soft tissue shockwave therapy sessions are covered, ultimately facilitating a smoother path to recovery and improved functionality.

Soft tissue shockwave therapy (STSWT) can be a valuable treatment option for many, but insurance coverage varies. Understanding your policy’s stance and navigating the claims process are essential steps in accessing this innovative therapy. While not all insurers cover STSWT sessions, some are beginning to recognize its benefits, leading to increased reimbursement potential. By staying informed about your rights and exploring available options, you can maximize your chances of receiving coverage for this effective treatment.