Promotional financing provides consumers with accessible, flexible options for substantial purchases like vehicle enhancements and detailing services. By prioritizing lifestyle choices and personal expression, it allows customers to achieve their aspirations without immediate financial burden. In a competitive digital market, businesses leveraging promotional financing for premium services can enhance engagement through personalization and data analytics, fostering stronger brand connections and increased sales. This approach empowers buyers to upgrade vehicles and homes with desirable enhancements using tailored repayment plans suited to their budget.

In today’s market, big-ticket purchases can seem daunting. However, promotional financing offers a solution, simplifying these transactions and making them more accessible. This article explores how promotional financing acts as a catalyst for consumer spending by understanding its potential, implementing effective strategies, and focusing on customer perspectives. We delve into practical approaches to enhance engagement and provide payment plans that cater to diverse needs, ultimately unlocking a new level of purchasing ease.

- Understanding Promotional Financing: Unlocking Big-Ticket Potential

- Strategies for Effective Promotion: Enhancing Consumer Engagement

- Simplifying Payment Plans: A Customer's Perspective

Understanding Promotional Financing: Unlocking Big-Ticket Potential

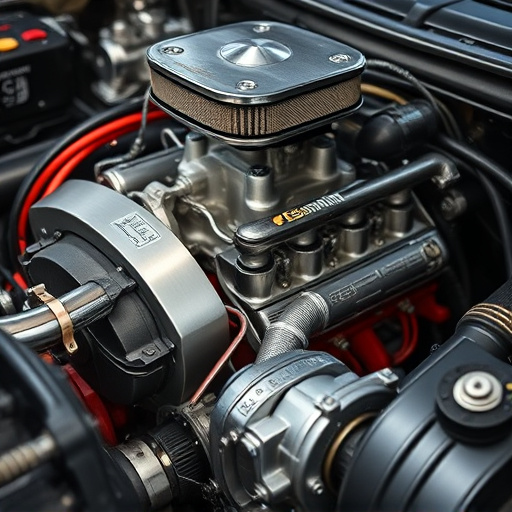

Promotional financing is a powerful tool that enables consumers to unlock the potential of significant purchases, such as vehicle enhancements or automotive detailing services. By offering flexible payment plans and competitive interest rates, this financial strategy makes it easier for individuals to afford high-value items like custom vinyl wraps. It’s not just about providing access to credit; promotional financing focuses on creating opportunities that enhance lifestyle choices and personal expression.

In today’s market, where big-ticket items are becoming increasingly prevalent, understanding promotional financing can be a game-changer. It allows customers to transform their desires into reality without the immediate financial burden. Whether it’s customizing your ride with stunning vinyl wraps or investing in home improvements, this financing option offers a path to acquisition that aligns with one’s budget and financial goals, ensuring that even the most ambitious projects become achievable.

Strategies for Effective Promotion: Enhancing Consumer Engagement

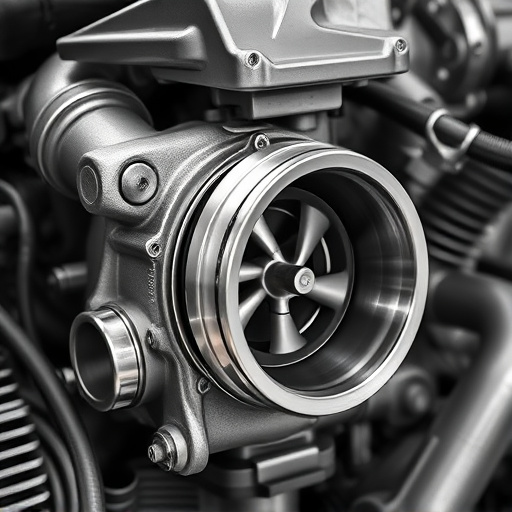

In today’s digital age, consumers are bombarded with countless promotional offers every day. To stand out from the competition, businesses offering promotional financing for big-ticket items like premium automotive services, ceramic window tinting, or vehicle wraps must employ innovative strategies to engage their target audience effectively. One key approach is personalization; tailoring promotions to individual customers’ preferences and behaviors makes them feel valued and understood. This can be achieved through data analytics, which helps identify consumer trends and allows for more precise marketing campaigns.

Interactive content is another powerful tool for enhancing consumer engagement. Rather than simply showcasing products or services, businesses can create experiences that involve the customer. For example, offering virtual consultations for vehicle wraps or augmented reality filters to visualize ceramic window tinting options brings promotions to life, fostering a deeper connection between consumers and brands. By integrating these strategies, promotional financing providers can captivate their audience, fostering long-term relationships and increasing the likelihood of successful sales.

Simplifying Payment Plans: A Customer's Perspective

For many customers, purchasing a big-ticket item like a new vehicle or implementing home enhancements can be daunting due to financial constraints. This is where promotional financing comes in as a lifesaver. When it comes to customer experience, simplifying payment plans makes the entire process much less stressful and more accessible. Instead of facing a large, lump-sum payment, buyers can opt for tailored repayment options that align with their budget.

Promotional financing offers flexible terms, making high-value purchases more manageable. For instance, when considering vehicle enhancements like heat rejection or scratch protection, customers can choose from various plans without feeling pressured. This approach not only helps individuals afford desirable upgrades but also encourages them to make informed decisions about their spending, ensuring they get the most out of their investments.

Promotional financing is a game-changer that allows consumers to access big-ticket items without the usual financial burden. By understanding this concept and implementing effective strategies, businesses can enhance customer engagement and satisfaction. Simplifying payment plans makes high-value purchases more attainable for buyers, fostering a positive shopping experience and encouraging future transactions. Embracing promotional financing is a key strategy for both retailers and consumers in today’s market.