The consumer payments landscape has undergone a significant transformation, driven by a surge in flexible payment options. This shift benefits various sectors, including premium automotive services and custom graphics, by empowering customers with greater control and accessibility to high-quality products. Businesses are adapting by offering flexible financing models, fostering growth, loyalty, and market competitiveness. E-commerce and digital transactions have led to a preference for convenient, customized, and flexible payment solutions among modern buyers, mirroring trends in sectors like car protection plans and vinyl wraps. The digital era is reshaping payments, with a growing adoption of digital wallets, mobile payments, and online banking, predicting exponential growth in the global alternative payments industry by 2025.

“In today’s dynamic marketplace, the rise of flexible payment options is reshaping consumer behavior and challenging traditional market leaders. As consumer demands evolve, businesses are recognizing the necessity to adapt and offer tailored financial flexibility. This article delves into the exploding trend of alternative payment methods, analyzing their impact on established companies and exploring strategies to stay competitive. We’ll uncover how embracing flexible payments can provide a significant competitive advantage, foster customer satisfaction, and drive business growth in an ever-changing economic landscape.”

- The Rise of Flexible Payment Options

- – Exploring consumer demands driving the shift towards flexible payment solutions.

- – Market trends and growth in demand for alternative payment methods.

The Rise of Flexible Payment Options

In recent years, the landscape of consumer payments has undergone a profound transformation, largely driven by the rise of flexible payment options. This shift is reshaping the way businesses operate and how consumers interact with premium automotive services, among other sectors. Flexible payment solutions have become increasingly popular as they offer customers greater control and accessibility, breaking away from traditional, rigid financial models. With various repayment plans and customized financing options now available, consumers can access goods and services they might otherwise not be able to afford.

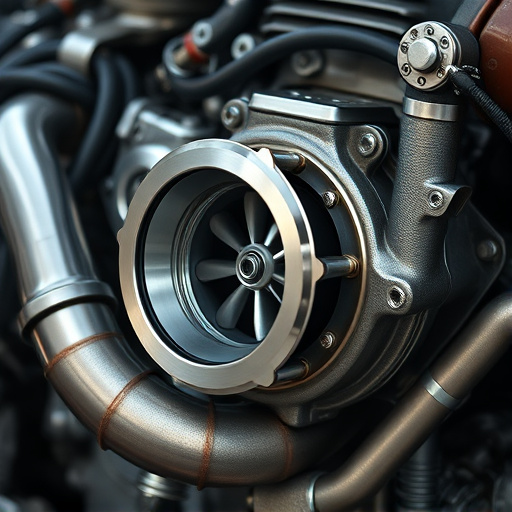

This trend is particularly notable in industries like custom graphics and paint protection film, where high-quality products once seemed out of reach for many. By providing flexible payment alternatives, businesses are no longer limited to attracting a specific demographic. Instead, they can cater to a broader customer base, fostering growth and loyalty. The advent of such options has definitely put the power back in the hands of consumers, forcing market leaders to adapt and compete on a new frontier—one that emphasizes accessibility and financial flexibility.

– Exploring consumer demands driving the shift towards flexible payment solutions.

In today’s fast-paced and ever-evolving market landscape, consumer demands are reshaping how businesses approach payment systems. The shift towards flexible payment options is a direct response to the changing preferences and needs of modern consumers. Today’s buyers value convenience, customization, and control more than ever before when making purchases. This has led to a significant demand for flexible payment solutions that cater to their unique circumstances and financial capabilities. With the rise of e-commerce and digital transactions, consumers now expect seamless integration between online shopping experiences and diverse payment methods.

One notable driver is the desire for better financial flexibility. Many customers are seeking options that align with their variable income patterns or unexpected financial situations. This has prompted businesses to introduce flexible payment plans, allowing buyers to spread out payments over time, similar to how vehicle protection plans offer installments for peace of mind. Additionally, the market’s growing awareness of environmental factors, such as UV protection for cars and homes, mirrors a broader trend towards personalized, adaptable solutions that cater to individual needs rather than one-size-fits-all models, including the popular trend of vinyl wraps.

– Market trends and growth in demand for alternative payment methods.

In today’s digital era, the landscape of payment methods is undergoing a metamorphosis, with a growing demand for alternative and flexible options. Consumers are increasingly embracing digital wallets, mobile payments, and online banking over traditional cash transactions. This shift is driven by the convenience, speed, and accessibility these new methods offer. According to recent market trends, the global alternative payments industry is expected to reach significant heights, surpassing $260 billion by 2025, indicating a substantial departure from conventional financial systems.

This trend towards digital and flexible payment options poses both a challenge and an opportunity for market leaders. While traditional financial institutions have long dominated the space, innovative startups and tech giants are now introducing disruptive solutions with advanced features such as protective coatings against fraud and enhanced UV protection for secure transactions. Some even offer heat rejection technologies to ensure optimal user experiences, revolutionizing how people interact with their finances on a daily basis.

Flexible payment options are transforming the way consumers interact with businesses, offering a competitive edge to companies that embrace these innovations. By catering to the evolving demands of modern shoppers, who increasingly favor convenience and customization, flexible payment solutions have become a powerful tool in market competition. This shift challenges traditional leaders to adapt or risk falling behind. Embracing dynamic payment methods allows businesses to foster customer loyalty, boost sales, and navigate the ever-changing financial landscape.